According to the Securities and Exchange Commission, three Plano oil companies and their executives took $11.7 million from investors – some of whom had no investment experience and had very little knowledge of the oil and gas industry.

The complaint filed in a Sherman federal court says investors were misled about locations and productions of wells, sales commissions, and the backgrounds of some of their executives. They are also accused of creating false tax forms.

The three companies named were AmeraTex Energy, Lewis Oil Corporation, and Lewis Oil Company. The executives named in the complaint included:

Thomas A. Lewis, residing in Albany, KY, ownerWilliam R. Fort, of Greenville, former president of AmeraTex EnergyDamon L. Fox, of Rowlett, former accountant for AmeraTex Energy and Lewis Oil Corp.Brian W. Bull, of Dallas, former compliance coordinator for AmeraTex Energy and Lewis Oil Corp

The companies sold Kentucky oil well shares to more than 150 people. None of the limited partnerships sold were registered with the SEC, and the sales staff was not licensed to sell securities.

According to the complaint, almost all their money was raised from investors rather than oil drilling income. Not surprisingly, investors received zero to very nominal returns.

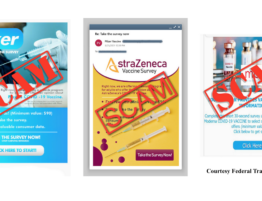

The Harris Firm regularly represents investors who have been defrauded by unscrupulous individuals who make false and/or misleading claims about returns. Many of the individuals who tout these investment schemes are smart and have deceiving appearances, including a website, Facebook page, testimonials and documentation.

It’s always a wise decision to discuss any investment with an attorney before money exchanges hands – particularly one in which you have limited knowledge. Please feel free to contact our firm if we can be of any help before you invest in any venture.